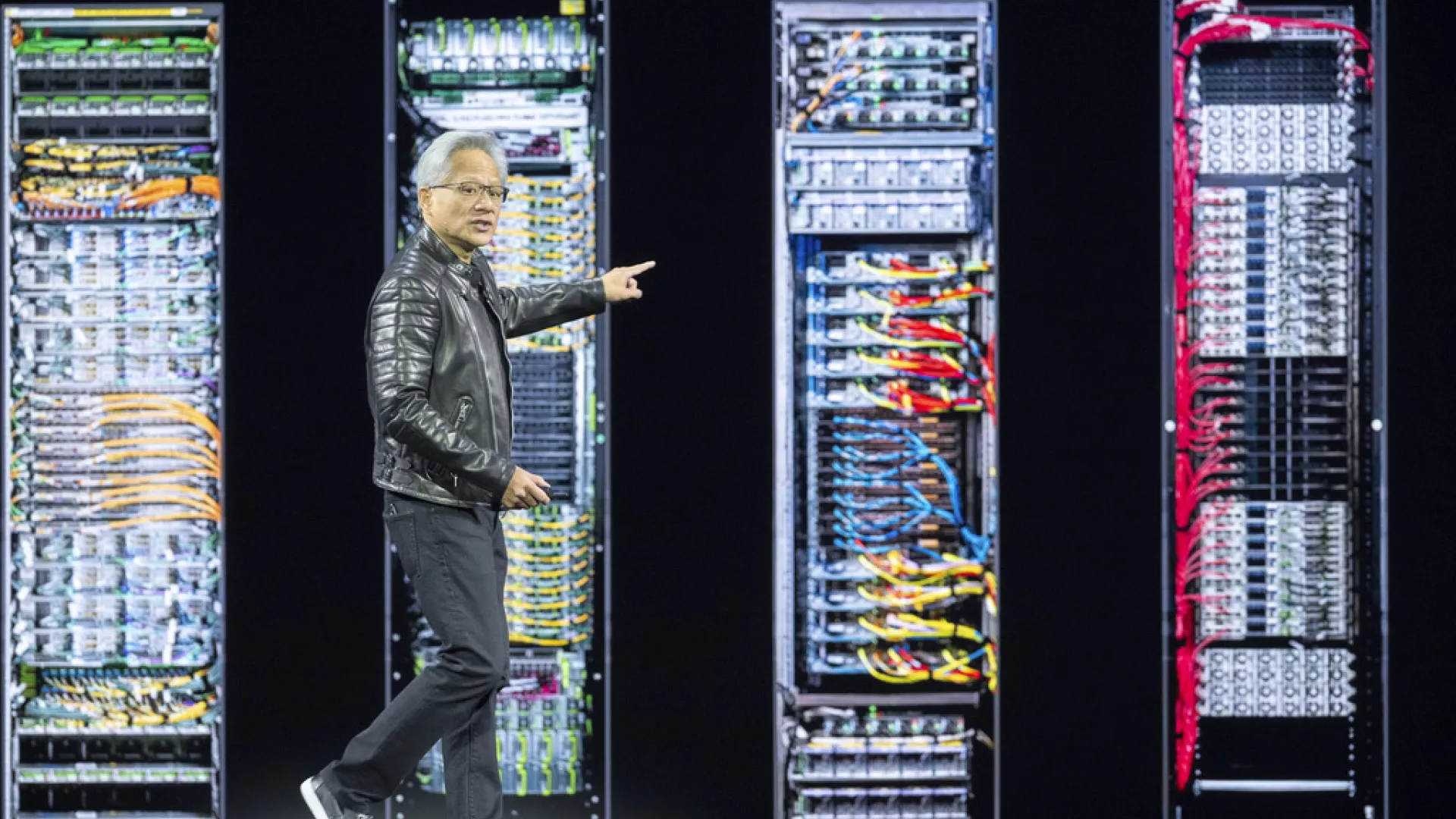

At the annual (GTC) in San Jose, California, Nvidia unveiled its latest generation of artificial intelligence (AI) chips, fueling future advances in robotics and self-driving automobiles. However, its shares tumbled more than 3% following the announcement, as investors continued to sell technology stocks amid economic worries caused by Trump’s tariffs. The remaining equities in the Magnificent Seven group also finished the session down.

The AI powerhouse’s stock has fallen 15% this year, driven down by global risk-off sentiment and the launch of Chinese DeepSeek’s cheaper AI model. Furthermore, the company’s most recent quarterly results report fell short of expectationsas sales growth slowed. However, Josh Gilbert, a market analyst at eToro Australia, stated: “Investors may see that as an opportunity, especially because its valuation remains favorable in the face of continuous expansion.

The GTC, a major gathering of global AI developers and investors, is a critical event for Nvidia. During the week-long conference, the chipmaker needs persuade hyperscalers to continue their significant investment in its next-generation chips.

This is especially relevant in light of DeepSeek’s recent development of a low-cost generative AI model, which offers a competitive challenge to prominent US IT corporations.

Also Read:

Key Trends Developing in Global Equity Markets

The ECB identifies Trade Tariffs and the Competitiveness Gap as Growth Threats